Over the past year and a half, the world has been battling a pandemic that has made the future foggy. Despite the uncertainty, many governments and companies are throwing their hat into the ring for a green recovery. If anything, businesses are deepening their commitment to sustainable development.

So, what does the future look like 10-30 years from now? Here are our seven predictions for the future of corporate sustainability.

Our prediction: Shareholder capitalism will give way to stakeholder capitalism.

Shareholder capitalism has been the dominant system of corporate governance for the past 50 years. It puts the interests of shareholders above all others, leading companies to operate with the sole purpose of maximising profits and returning the highest possible dividends.

Made popular by Nobel-prize winning economist Milton Friedman in the 1970s, shareholder primacy was argued to create the best outcomes for society by focusing executives on one priority, thereby avoiding indecision and conflicts of interest within the company.

Several decades later, shareholder capitalism has seen the exploitation and abuse of workers around the globe (40.3 million people are in modern slavery), rising economic inequality (the wealth gap between America’s poorest and richest has doubled), and significant environmental degradation of our land, oceans and atmosphere. Decreasing CEO tenure is further evidence of an increasing focus on the short-term. Former General Electric Chairman Jack Welch labelled shareholder primacy as the “dumbest idea in the world”.

The consequences of shareholder capitalism have led to widespread public backlash and a call for change. We predict that we’ll see a move towards a different model of corporate governance. Right now, the strongest contender is stakeholder capitalism, which was the theme of the 2020 World Economic Forum. The model espouses that companies should look after the interests of all their stakeholders – customers, employees, suppliers, communities, and shareholders.

The shift to stakeholder capitalism has been supported by business groups like the Business Roundtable, large institutional investors such as BlackRock, progressive economists such as Nobel-prize winnerJoseph Stiglitz, and a wide range of large companies such as Salesforce.

While there is still work to be done to identify how this new corporate governance model can best be applied, the winds of change are beginning to blow.

Our prediction: The field of corporate sustainability will grow wider and deeper.

As it stands today, some industries face much greater scrutiny while others manage to fly under the radar. Primary industries (e.g. mining) and secondary industries (e.g. manufacturing) bear the brunt of criticism. The Global Reporting Initiative is developing sector-specific standards only for primary-industry sectors – oil and gas, coal, and agriculture, aquaculture and fishing. The focus is understandable, given the significant impacts of these sectors.

However, this focus has meant many sectors in the tertiary (e.g. financial services) and quaternary (e.g. tech) industries have escaped larger scrutiny. A survey of 1000 large companies found that almost nobody knew about ‘sustainable tech’, with only 6% of companies including a policy to reduce the environmental impact of their IT activities.

However, tech has large impacts through its supply chain in raw material production, and on the consumer end through planned obsolescence. Technology also has significant environmental impacts. A lifecycle assessment of common AI training found the process emitted nearly five-times the lifetime emissions of the average American car. Data centres account for nearly 1% of the world’s energy demand with this figure expected to increase. And bitcoin mining uses more electricity than entire countries like Ireland.

We predict that the importance of sustainability will extend beyond primary and secondary industries and grow wider in reach. Previously overlooked industries, such as tech, will face significant scrutiny, especially as quaternary industries continue to grow in size and share.

Not only will sustainability grow wider. We expect that it will continue to deepen. Companies will be expected to have extensive expert knowledge across a variety of sustainability topics.

We initially had 8 Millennium Development Goals in 2000. This grew to 17 Sustainable Development Goals in 2015 and to a further 169 targets in 2017.

Not only have the global policy settings deepened, reporting requirements have too. In 2014, the G4 Standards had 94 pages. In 2016, the GRI Standards were released with a whopping 443 pages. The most recent 2020 version has grown to 575 pages. A small sustainability team won’t cut it. Companies will be expected to field experts in human rights, privacy, ethical procurement, biodiversity and more to meet these deepening expectations.

Our prediction: ‘Alternative‘ green products will become the norm.

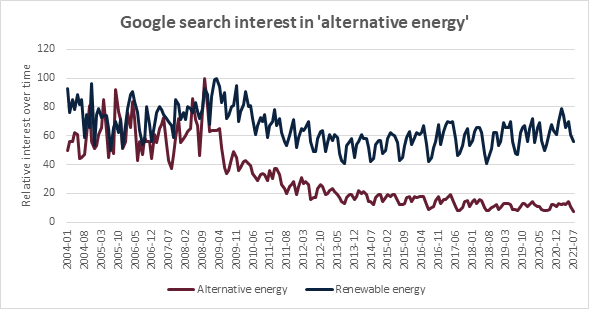

When renewable energy first entered into public discourse, products were referred to as ‘alternatives’. It took several years before the term wore out and they moved from ‘alternative’ to ‘mainstream’.

Source: Google trends, tracking worldwide trends from 2004-present.

Renewable energy is just one of the many green products on the market labelled ‘alternative’. There are alternative materials, packaging and meats. Interest in these green products has been shown to be more than fantasy. We predict that over time these alternatives will become the norm.

Renewable energy is now responsible for 29% of global electricity generation. Over the past decade, renewable energy use has grown at an average rate of 13.7% per year. In Europe, renewable energy overtook fossil fuels, in the first half of 2020 – responsible for 40% of electricity generation compared to the 34% of fossil fuels.

Growth in renewable energy is paralleled in alternative meats. From January to August of 2020, Impossible Foods went from being stocked in 150 American grocery stores to 9000. The market isn’t just a vegetarian niche, 90% of those consumers were meat-eaters. The global meat substitutes sector is now worth US$20.7 billion and is set to grow with the world’s largest meat processors, such as JBS, Tyson and Cargill, already offering their own alternative meat products.

Alternative packaging solutions are also beginning to blossom, with the sector expected to grow at 9.25% per year over the next five years. Much of this growth is driven by governments, like Australia’s target for all packaging to be recyclable, compostable or reusable by 2025. The New Plastics Economy Global Commitment sets out a similar goal. With so much demand from consumers and drive from policymakers, these alternative products and services are not going away.

Our prediction: It will become the expected norm for companies be carbon neutral.

Becoming carbon neutral or achieving net zero has been an ambitious goal for many companies. As of September 2020, only 294 companies across the globe had reached net zero. In the future as we decarbonise the economy, we will see this ambition become the norm.

Already, many companies are setting targets to be net zero. One fifth of the world’s 2,000 largest companies have made these commitments, and these numbers are only increasing. The number of commitments have doubled in less than a year. Most are aiming for a zero-carbon economy by 2050 as part of the UN Race to Zero. This UN corporate coalition involves more than 3000 businesses and over 700 cities worldwide.

As more and more companies strive towards carbon neutral, it will no longer be unusual for companies to achieve this milestone. Instead, it will become the minimum standard. The road to a neutral economy remains a challenging feat while we wait for finance, policies and technology to catch up, but it is inevitable. Just as customers buy food expecting it to be safe from the get-go, without additional labelling, they will also assume products are carbon neutral.

Our prediction: Corporate sustainability will explode in the East.

During the 20th century, the world’s economic centre of gravity sat somewhere in the north Atlantic Ocean. This centre of gravity is rapidly shifting east and by 2050, it’s expected to sit near northern India.

This shift in economic power will shape the future of sustainability. There will be increasing expectations on the East to meet higher sustainability standards. And in turn, a ramping up of sustainability efforts to meet these expectations.

Already, China has overtaken the US as the world’s top consumer of renewable energy in 2018. This continues to grow. And it is growing far faster than elsewhere, at 33.4% per year (compared to the average 13.7%). This is part of its 5-year economic plan that prioritises sustainable development.

The corporate sustainability sector in Asia is beginning to catch on. Since 2017, there has been year-on-year growth (1-13%) in the number of reporting organisations in South Asia. With companies across Asia starting to take up global sustainability initiatives, such as the Taskforce on Climate-Related Disclosures, the future will only grow the region’s corporate maturity in this area.

Our prediction: Newer industries, like tech, will mature with new corporate and regulatory frameworks reining in their novel sustainability issues.

Even now tech is a fairly fresh industry. It hasn’t gone through many decades, let alone centuries, of scrutiny and improvement. The banking system has had over 500 years to have its problems tested and mitigated. For tech, we face a multitude of problems – privacy, security, the threat of AI.

The digital revolution has created many new industries with a wide array of innovative products. With each innovation comes a novel and unforeseen sustainability problem. And regulation is struggling to keep up. Ten years ago, social media was relatively new – an exciting way to connect people around the world. Today, we are seeing its darker side. The onslaught of ‘fake news’ can lead to large misinformed communities such as anti-vaxxers or certain diet groups that collectively impact on positive public health. Not only that, social media can be weaponised by companies and nations to significantly influence democratic elections.

Companies enabled by new technology, like Uber and Amazon, also face their own significant challenges, particularly around labour. Cloud and internet-service companies are tackling data privacy and protection issues.

All of these challenges are part and parcel of the relative novelty of the tech industry, lacking the appropriate social and regulatory frameworks to rein it in. We predict that the next several decades will be a constant race to keep up and manage this growing pool of sustainability issues. The tech industry’s approach to sustainability will mature, covered by appropriate regulation and enforcement, and supported by education.

Already, some countries have been attempting to regulate fake news, and courts have been pushing back on gig economy companies like Uber. The EU’s General Data Protection Regulation (GDPR) is the most comprehensive and toughest data privacy and security legislation seen yet. The wheels are turning to adapt to these innovative industries.

Our prediction: Sustainability information will become a core part of investment decision making.

While technological, political and social changes globally are shaping the future of sustainability, it is the flow of money that will drive much of the change. Investors are now backing green.

The growth of sustainable investing has grown by 107.4% since 2012, and accounts for 18% of all assets in the wealth industry. In the US, this is even higher with 33% of all managed US assets investing sustainably. More and more investors are interested in investing responsibly, with 84% of younger people seeking to invest in ESG funds.

It’s not just ESG-focused funds that are backing green. European financial services group Nordea Asset Management dropped JBS, Brazil’s largest meat processor, from its portfolio for failing to address investor concerns about deforestation. And this was not even Nordea’s ESG-focused fund. The world’s largest fund manager, BlackRock, has issued a warning that they will divest from companies that do not decarbonise. Non-financial information, such as sustainability, is becoming central to investment decisions.

Australian superfunds, as long-term investments, are even more conscious of investing sustainably. Currently, funds that follow ESG principles manage over $1.6 trillion, about 71% of super savings overseen by the Australian Prudential Regulatory Authority (APRA).

In the next few decades, investors will follow the changes in the wind and back a more sustainable future. Not just because of social expectations, but because it makes financial sense.

What are your predictions for the future of corporate sustainability?